See This Report on Non Profit Organizations Near Me

Table of ContentsNon Profit Organizations Near Me - The FactsEverything about 501c3 OrganizationAll About 501 CA Biased View of 501c3 Organization9 Simple Techniques For Npo Registration501 C - Truths

While it is safe to say that the majority of charitable organizations are honorable, companies can certainly experience a few of the same corruption that exists in the for-profit business world - non profit organization examples. The Message discovered that, in between 2008 as well as 2012, even more than 1,000 nonprofit companies checked a box on their IRS Kind 990, the tax return kind for excluded companies, that they had experienced a "diversion" of assets, suggesting embezzlement or other scams.4 million from purchases linked to a sham business begun by a previous aide vice head of state at the company. Another example is Georgetown College, that endured a considerable loss by a manager that paid himself $390,000 in additional payment from a secret checking account previously unidentified to the university. According to federal government auditors, these tales are all as well usual, as well as serve as sign of things to come for those that seek to produce and run a philanthropic organization.

When it comes to the HMOs, while their "promo of health and wellness for the benefit of the neighborhood" was deemed a philanthropic function, the court determined they did not run mostly to benefit the community by offering health services "plus" something added to profit the area. Hence, the abrogation of their excluded status was maintained.

All About Non Profit Organization Examples

There was an "overriding government passion" in prohibiting racial discrimination that exceeded the institution's right to totally free workout of religion in this way. 501(c)( 5) Organizations are labor unions and farming and horticultural organizations. Organized labor are organizations that create when workers associate to participate in cumulative bargaining with an employer regarding to earnings and benefits.

By comparison, 501(c)( 10) organizations do not attend to repayment of insurance advantages to its participants, therefore may set up with an insurer to provide optional insurance policy without endangering its tax-exempt status.Credit unions and other common financial organizations are categorized under 501(c)( 14) of the IRS code, and, as part of the banking industry, are heavily managed.

About 501c3 Organization

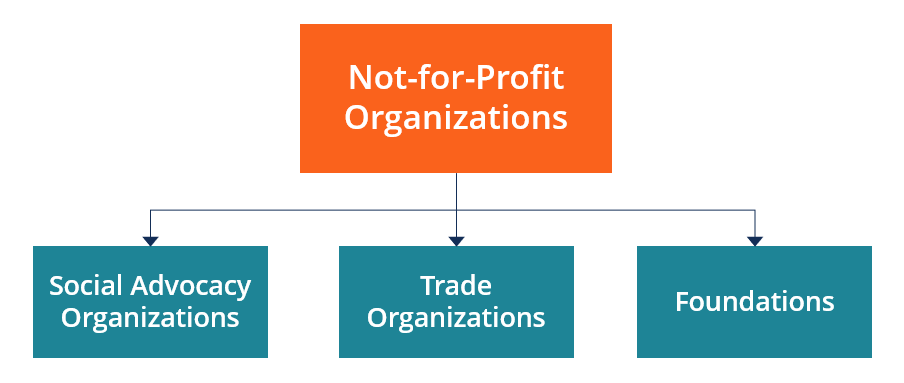

Getty Images/Halfpoint If you're thinking about beginning a not-for-profit company, you'll desire to comprehend the various kinds of not-for-profit classifications. Each classification has their own demands as well as compliances. Right here are the sorts of nonprofit classifications to aid you make a decision which is appropriate for your company. What is a not-for-profit? A nonprofit is an organization operating to further a social reason or sustain a common mission.

Supplies payment or insurance coverage to their participants upon illness or various other terrible life occasions. Membership has to be within the same office or union.

g., over the Internet), even if the not-for-profit does not straight obtain contributions from that state. On top of that, the internal revenue service needs disclosure of all states in which a not-for-profit is signed up on Form 990 if the nonprofit has earnings of greater than $25,000 each year. Charges for failure to sign up can include being required to give back contributions or encountering criminal charges.

Things about Not For Profit Organisation

com can assist you in signing up in those states in which you plan to solicit contributions. A not-for-profit organization that obtains significant sections of its income either from governmental resources or from direct contributions from the general public may certify as an openly supported company under area 509(a) of the Internal Revenue Code.

Due to the complexity of the laws and also policies regulating classification as a publicly supported company, integrate. The majority of people or groups develop not-for-profit corporations in the state in which they will largely operate.

A nonprofit corporation with organization locations in numerous states might develop in a single state, after that sign up to do business in various other states. This suggests that not-for-profit firms have to officially sign up, file annual records, and also useful content pay annual fees in every state in which they conduct company. State laws require all not-for-profit companies to maintain a signed up address with the Assistant of State in each state where they work.

The Single Strategy To Use For 501 C

Area 501(c)( 3) charitable companies may not intervene in political projects or conduct significant lobbying activities. Speak with a lawyer for even more particular info not for profit sector concerning your organization. Some states just require one supervisor, but the majority of states need a minimum of three directors.

An enterprise that serves some public purpose and also consequently takes pleasure in unique therapy under the legislation. Nonprofit companies, unlike their name, can make a revenue yet can't be made mostly for profit-making. When it concerns your business structure, have you believed regarding organizing your endeavor as a nonprofit corporation? Unlike a for-profit company, a not-for-profit might be eligible for particular benefits, such as sales, residential property and revenue tax exemptions at the state degree (501c3 nonprofit).

The Non Profit Ideas

One more significant distinction in between an earnings and nonprofit service deals with the treatment of the revenues. With a for-profit organization, the proprietors and shareholders typically get the profits. With a nonprofit, any type of cash that's left after the organization has paid its expenses is put back into the organization. Some types of nonprofits can get payments that are tax obligation insurance deductible to the individual who adds to the organization (501 c).